Kantar, a global leader in data insights, has revealed the first ever true data picture of CBD consumer behaviour in the UK.

Through the Shoppix app, Kantar monitored 100,000 shoppers in the UK over a year up to August 2021, scanning receipts from all categories across all shopping channels.

The data reflects behaviour and shopping trends in periods of lockdown and re-openings, analysing how these affected retail sales and consumer spending.

The Worldpanel Plus researchers said 35% of UK shoppers have never tried any products which contain CBD, but have ‘no objection to trying them in the future,’ according to a 2021 survey of 10 million UK households.

Bigger baskets, fewer shopping trips

British shoppers were spending more on CBD purchases in the second half of 2021 than before the pandemic, but on a less frequent basis. On average, every shopping trip increased in value by £2.28 (up 15%). However, the frequency of shopping trips was down 10%.

A report by the Association for the Cannabinoid Industry (ACI) found that sales of CBD products grew exponentially in 2021, with £690 million forecasted in annual sales.

Online spend is twice as much as in-store

The Worldpanel Plus report indicates that shoppers are spending twice as much per trip at online checkouts, compared to physical store buys. An increase in online shopping versus in-store visits is perhaps unsurprising given the limitations on bricks and mortar stores of recent years. Kantar’s research suggests online sales peaked at +44% in November 2020, and were approximately 30% higher at the end of 2021.

Source: Kantar Worldpanel Plus

How has the pandemic reshaped CBD consumer behaviour in the UK?

The first survey of real consumer CBD purchases demonstrates three behaviour changes:

- British consumers are more purposeful when shopping and bigger trips to the checkout are here to stay.

- CBD is a truly omni-channel category where both environments play different but crucial roles. Online sales account for 47% of purchases, with 53% happening in-store.

- Consumer demography is having a direct impact on the channels we buy in…

According to the data, those in the ‘post-family’ category – meaning households whose adult children have left the family home – account for 52% of sales and are attracted to CBD gift sets and herbal supplements.

Meanwhile, those in the ‘pre-family’ stage are interested in nutritional supplements and cosmetics, but this demographic only accounts for 20% of sales.

It’s the older, post-family group which interested the research team at Kantar the most, as it is something, they say, would have been ‘implausible back in 2019’.

Consumer Insight Director for Kantar’s Worldpanel Division, Christine Bradford, explains:

“Products containing CBD cater to a breadth of life stages, including a large post-family audience. This is closely linked with the shape of the UK’s population and highlights how these products fulfil a broad range of needs.

“The success of the category largely depends on successfully converting more people into CBD shoppers, so this wide-ranging appeal is extremely encouraging for the future of CBD.”

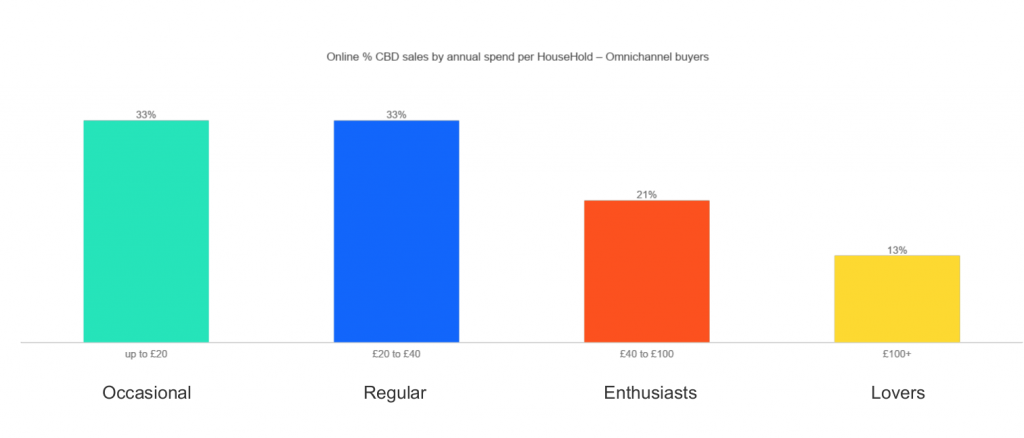

The majority of those spending on CBD products fall into two categories, according to the report. CBD enthusiasts, who believe in the product and see positive results, and CBD lovers, the most loyal consumers who might have a favourite, trusted brand which they revisit.

Together, these two categories account for a third of shoppers, and collectively, these groups are spending the most on products. CBD lovers spend 4.5 times more on CBD products than occasional buyers do. The biggest fans of CBD are spending upwards of £100 on a product, compared to occasional users spending up to £20 online, according to Kantar’s research.

CBD consumer behaviour in the UK | Source: Kantar Worldpanel Plus

The ACI has announced that its members are working closely with Kantar to provide further consumer trend reports on CBD in the UK, which, like this analysis, will draw upon real time UK shopper data combined with specific questions via targeted polling.

Laura Williamson, ACI member manager says:

“The goal is that members benefiting from this partnership will be better placed to reach potential customers who are on the fence about trying CBD.

“We also wish to help our members convert occasional buyers into the more lucrative CBD lovers category.”

Related: CBD in food: Leading futurologist casts predictions.